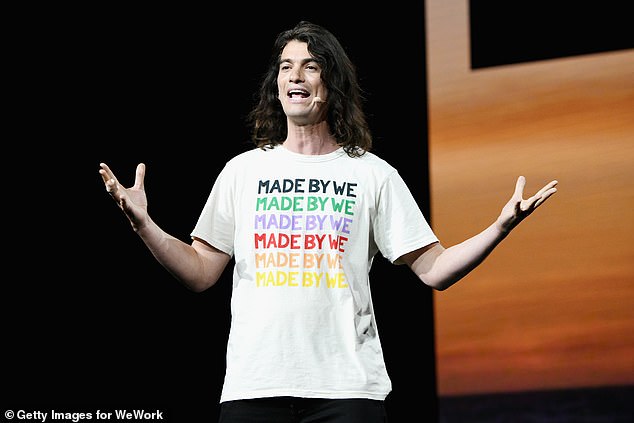

Adam Neumann, who took home a nearly $1billion golden parachute after he was ousted as CEO of WeWork, reportedly has purchased two waterfront properties near Miami Beach.

The eccentric businessman is in contract to buy two adjacent properties on Bal Harbour Marina.

The properties, which total 50,000 square feet, offer multiple slips in the marina.

Neumann, 42, will pay $44million for the properties to the seller, local investor Joseph Imbesi, according to The Wall Street Journal.

One of the parcels is being used to build a 14,000-square-foot home that is currently under construction.

Adam Neumann, who took home a nearly $1billion golden parachute after he was ousted as CEO of WeWork, has reportedly purchased two waterfront properties near Miami Beach

The eccentric businessman is in contract to buy two adjacent properties on Bal Harbour Marina. The properties, which total 50,000 square feet, offer multiple slips in the marina

The other parcel is an empty lot. Put together, the two hug 360 feet of coastline.

In the late 1990s, Imbesi bought up 10.5 acres of land in Bal Harbour for $19million. The two parcels purchased by Neumann are part of those 10.5 acres.

As part of the deal, Neumann received a $1million allowance for unfinished construction.

Tony Imbesi of Douglas Elliman, who is representing the seller, declined to comment on the deal while Brett Harris, also of Douglas Elliman, could not be reached for comment.

Neumann will pay $44million for the properties to the seller, local investor Joseph Imbesi

In the late 1990s, Imbesi bought up 10.5 acres of land in Bal Harbour for $19million. The two parcels purchased by Neumann are part of those 10.5 acres. The image above shows Bal Harbour Marina

Last month, it was reported that Neumann continues to receive lucrative considerations from WeWork, with a newly revealed stock award worth $245million bringing the total value of his exit package to nearly $1billion.

Neumann was granted the enhanced stock award in February as part of a renegotiation of his 2019 exit package, intended to smooth the way for WeWork’s public listing, according to regulatory filings first reported by the Wall Street Journal.

Hard-partying Neumann was once seen as a star of the business world, but his reputation was left in tatters after investors balked at his tequila-fueled management style and eccentric ways, derailing plans for a 2019 IPO.

The newly revealed stock award comes on top of Neumann’s previously reported $200million cash payout and favorable refinancing on $432million in debt, benefits reserved to Neumann after he was forced out when SoftBank bailed out the company two years ago.

An entity that Neumann controls was also allowed to sell $578million in WeWork stock, though other investors were given the same option.

Neumann oversaw one of the biggest business implosions in recent history, after WeWork’s valuation plunged from $47billion in early 2019 to less than $8billion later that year.

In total, the company had raised some $11billion from investors to build a company that is still worth less than that today.

The company supplies shared office space, an internet connection, cleaning service and a reception desk, making it popular with small firms and tech startups.

The payouts to Neumann are intended to smooth the way for WeWork to go public, effectively paying him off to give up his control of the company

Last month, WeWork reached a deal to go public at a valuation of $9billion through a merger with a special-purpose acquisition company.

The newly reported stock award is a renegotiated version of a prior 2019 agreement with Neumann, which gives him gains above a certain minimum share price.

The deal reached in 2019 set the share price threshold at $19, but the February settlement set it at $0 per share.

That effectively gives him around $245million worth of stock based on BowX’s current share price, which stood at $12.30 on Wednesday, but if the share price falls below $10, he will be ineligible to receive the stock award, according to the Journal.

The payouts to Neumann are intended to smooth the way to go public, effectively paying him off to give up his control of the company, which he wielded through shares that had 10 times the voting power of normal shares.

It comes two years after WeWork’s initial attempt to go public fell apart disastrously, when paperwork that the company filed for its IPO raised concerns about profitability and Neumann’s management style.

While Neumann’s investors were willing to entertain his eccentricities after co-founding WeWork in 2010, his free-wheeling ways and party-heavy lifestyle came into focus once he failed to get the company’s IPO underway.

SoftBank, already a major investor, intervened with a bailout and initially offered Neumann a package valued at $1.7 billion — but negotiations turned contentious and the Japanese firm later tried to slash his buyout.

Neumann ultimately stepped down as chief executive. Sandeep Mathrani is now CEO, and his work has included cutting costs by $1.6 billion, according to WeWork.

Now WeWork plans to go public through a merger with blank-check firm BowX in a deal that values WeWork at around $9 billion, a steep drop from the $47 billion the money-losing company was worth in a 2019 private funding round led by SoftBank.

‘Sometimes you don’t pick the path (and) a path picks you. In December, we were approached by BowX and other SPACS,’ CEO Mathrani told CNBC in an interview.

Adam Neumann and wife Rebekah Neumann are seen in 2018. Neumann’s investors were willing to entertain his eccentricities until WeWork’s IPO fell apart disastrously

‘We had seen a path to profitability and we thought it was a good time to raise additional liquidity to de-risk the balance sheet, and to make sure that we have a path to profitability,’ Mathrani added.

SoftBank will retain a majority stake in the company after the deal. SoftBank and other investors have agreed to a one-year lock-up on their shares, a person familiar with the matter told Reuters.

SPACs like BowX are shell companies that raise funds in an IPO with the goal of merging with an unidentified private company. For the company being acquired, the merger is an alternative way to go public over a traditional IPO.

WeWork said last week that it lost more than $2 billion in the first quarter of 2021 thanks to COVID-19 closures and the effects of the settlement deal with Neumann.

Neumann has kept a low profile since he was forced to resign after WeWork’s planned flotation on the stock market stalled and investors soured on the company, causing its value to plummet.

He and his wife Rebekah were thought to have fled the drama with a move to Israel but are now reportedly back in New York with their five children.

In April, the New York Post reported that Neumann was planning his next business venture ‘involving what happened in the world because of the pandemic’.

In October, reports surfaced of Neumann’s ‘tequila-fueled leadership style’.

Employees have spoken out about the ‘cult-like’ environment at WeWork and the behavior of its so-called ‘partyer in chief’ which included smoking marijuana on private jets and trying to become immortal.

At its peak it had coworking spaces in more than 110 cities in 29 countries with a valuation of $47billion. Neumann was put on a par with the likes of Steve Jobs as a Silicon Valley innovator who would change the world.

But Neumann’s office suites were absurd even by the standards of Silicon Valley bosses. In the early days he had a punching bag, a gong and a bar – later he had a private bathroom with a sauna and a cold-plunge tub at his office in New York.

WeWork hysteria reached its peak in 2017 when SoftBank invested $4.4billion in the company and Neumann declared its worth was based ‘more on our energy and spirituality’ than revenue.

He mused: ‘We are here in order to change the world – nothing less than that interests me’.

Neumann even talked about being the President of the United States, once joking he could be ‘President of the world’.

In April 2021 Neumann, 41, and his wife Rebekah Paltrow Neumann sold their 11-acre California estate shaped like a guitar for $22.4 million

The house sold 10 months after it was first put on the market with a $27.5 million price tag

The dream came crashing down last year when WeWork filed for its initial public offering which forced it to open up its finances to scrutiny.

That revealed huge black holes in its balance sheet and the company’s valuation plunged from $47billion to $10billion and the floatation was put on hold indefinitely.

In August last year Neumann sold his five-bedroom mansion in New York for $3.4million.

The six-acre country retreat in Westchester County includes a swimming pool, spa and slide as well as sports facilities, sprawling gardens and a dining terrace.

Separately, Neumann sold a $1.25million Hamptons getaway in February 2020 – making a loss on a property he had bought for $1.7million in 2012

Then in April 2021 Neumann, 41, and his wife Rebekah Paltrow Neumann sold their 11-acre California estate shaped like a guitar for $22.4 million, 10 months after it was first put on the market with a $27.5 million price tag.